Business Lending

Creating a seamless digital lending experience

Project Details

Domain: Banking

Role: Senior Experience Designer (Principal-level scope)

Duration: Multi-phase project, 12+ months

Team & Stakeholders: CX, UX, Product Owners, lending Managers, Relationship Mangers, Engineering, Compliance, Call Centre, Marketing, Brand

Westpac aimed to modernise its business lending process and deliver a seamless digital experience from application to drawdown. As part of the Experience Design (XD) team, I co-led Phase One, focusing on one of the biggest friction points: capturing applications efficiently and intuitively. Through research, prototyping, and usability testing, we identified key pain points, validated new flows, and laid the foundation for a smarter, more user-friendly lending journey.

Background

Westpac aimed to grow its business lending by modernising its operations. In the first “Optimise” phase, we analysed existing processes to identify pain points and quick wins. In the next “Modernise” phase, we looked beyond incremental fixes, exploring how new technologies could create a seamless online borrowing experience—from application to drawdown.

After Bevington analysed the current state of the business lending process, one of the main friction points emerged: capturing the application.

The end-to-end lending process involved 4,300+ steps, making it highly complex.

Multiple manual re-entries of application information created the most errors.

Asking customers the same questions repeatedly caused the highest frustration, particularly for existing clients.

Many said:

“You already know my business — why are you asking me to re-enter transaction details, financials, and other documents?”

The core question guiding the design became…

How can we simplify the application process to be more intuitive, efficient, and user-friendly, while still meeting business and compliance needs?.

What I did

As part of a newly formed Experience Design (XD) team under a new Chapter Area Lead, I co-led Phase One with a service designer. I ran research, managed stakeholders, facilitated sessions, created prototypes, and partnered with an external UX agency for usability testing.

Tasks & Responsibilities

Co-created experience maps using internal insights.

Mapped issues to journey steps and CRM systems.

Conducted competitor analysis to benchmark best practices.

Designed user flows and high-fidelity prototypes.

Facilitated brainstorming workshops with stakeholders.

Collaborated with a content designer and wrote prototype content.

Co-developed test scripts and recruited business customers for testing.

Participated in user testing and analysed feedback to inform design decisions.

Activities & outputs

→

Created experience maps using feedback from staff and Relationship Managers

→

Benchmarked against competitors, focusing on form structure and logic

→

Created flows and high-fidelity screens using our design system

→

Mapped pain points to journey steps and internal systems

→

Explored solutions with service designers and tech teams

→

Evaluated whether to use traditional forms or Typeform-like experience

Define & Design

Crafting the core Lending experience

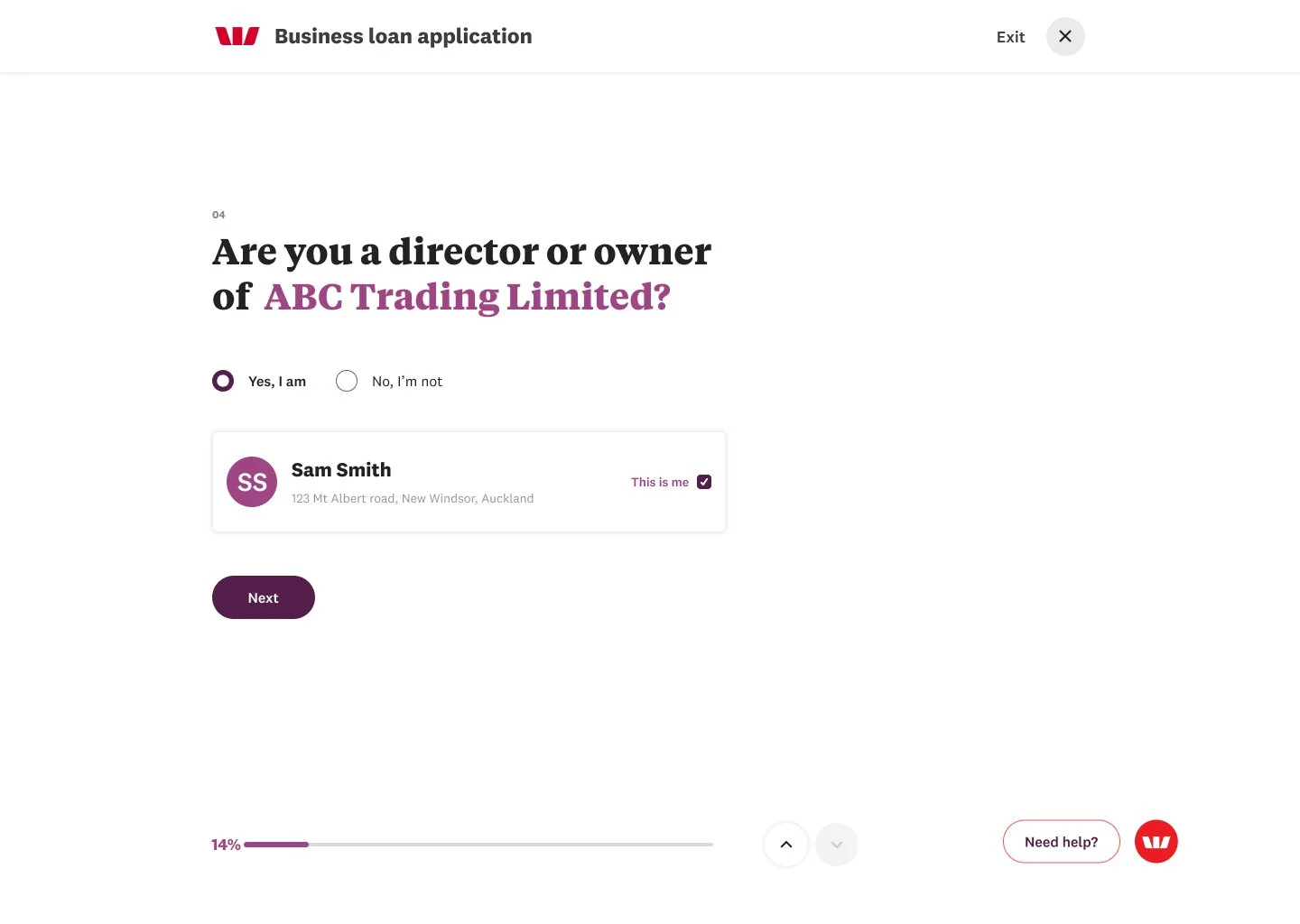

In this phase, we explored and defined the end-to-end business lending journey, designed user flows, wireframes, and high-fidelity prototypes, and validated concepts through usability testing. By collaborating closely with service designers, technical experts, product teams, and content designers, we created a simplified, intuitive, and user-focused digital lending experience ready for testing and iteration.

Core Journey Definition

We mapped out the end-to-end business lending journey and identified the core flow. Variations were added for different personas and contexts.

UX Impact: Ensures the design works seamlessly for all types of users and scenarios.

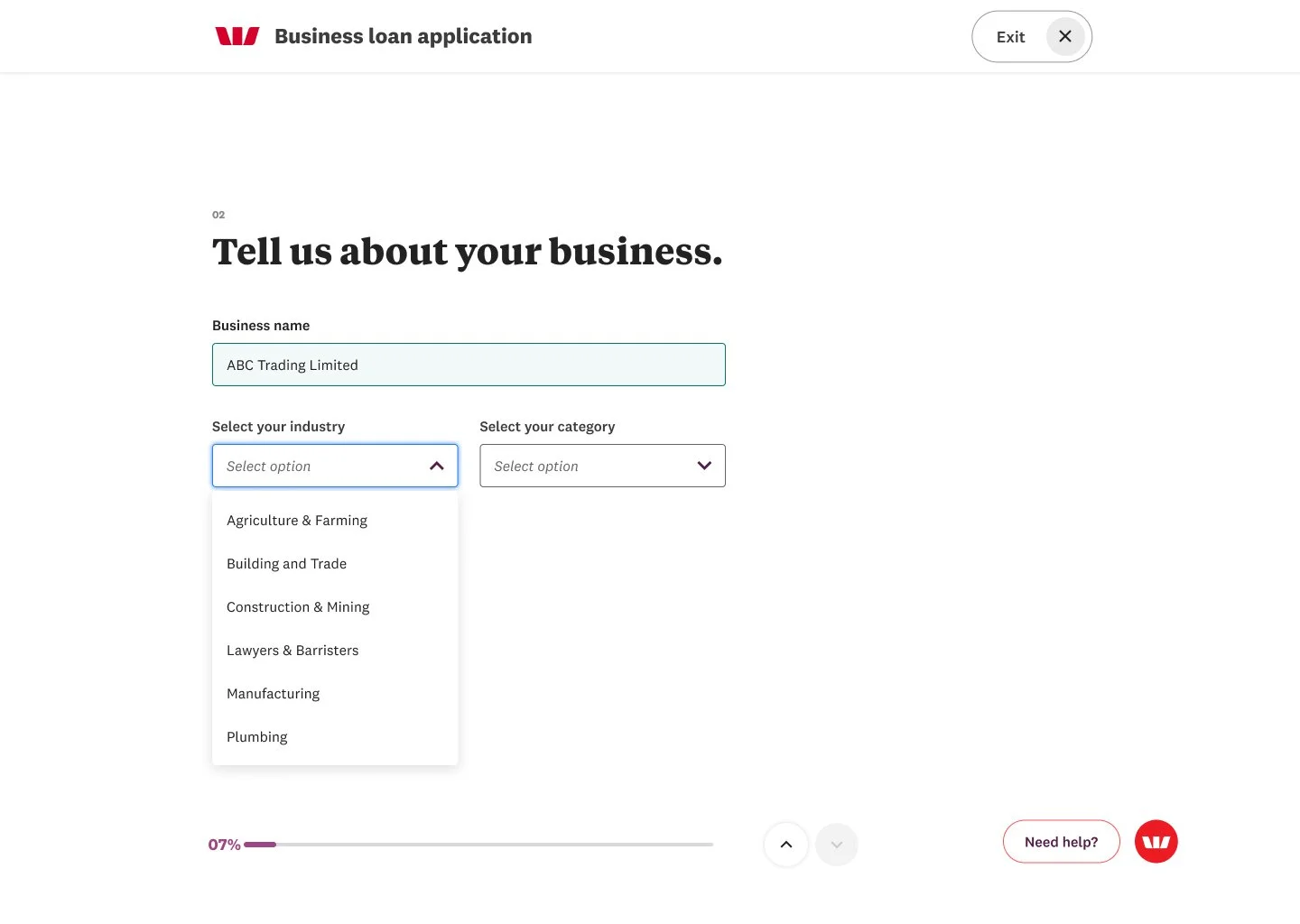

User Flows & Wireframes

Created user flows for the core journey and its variations. Built wireframes and high-fidelity screens using our design system.

UX Impact: Provides a clear visual guide for testing and stakeholder alignment.

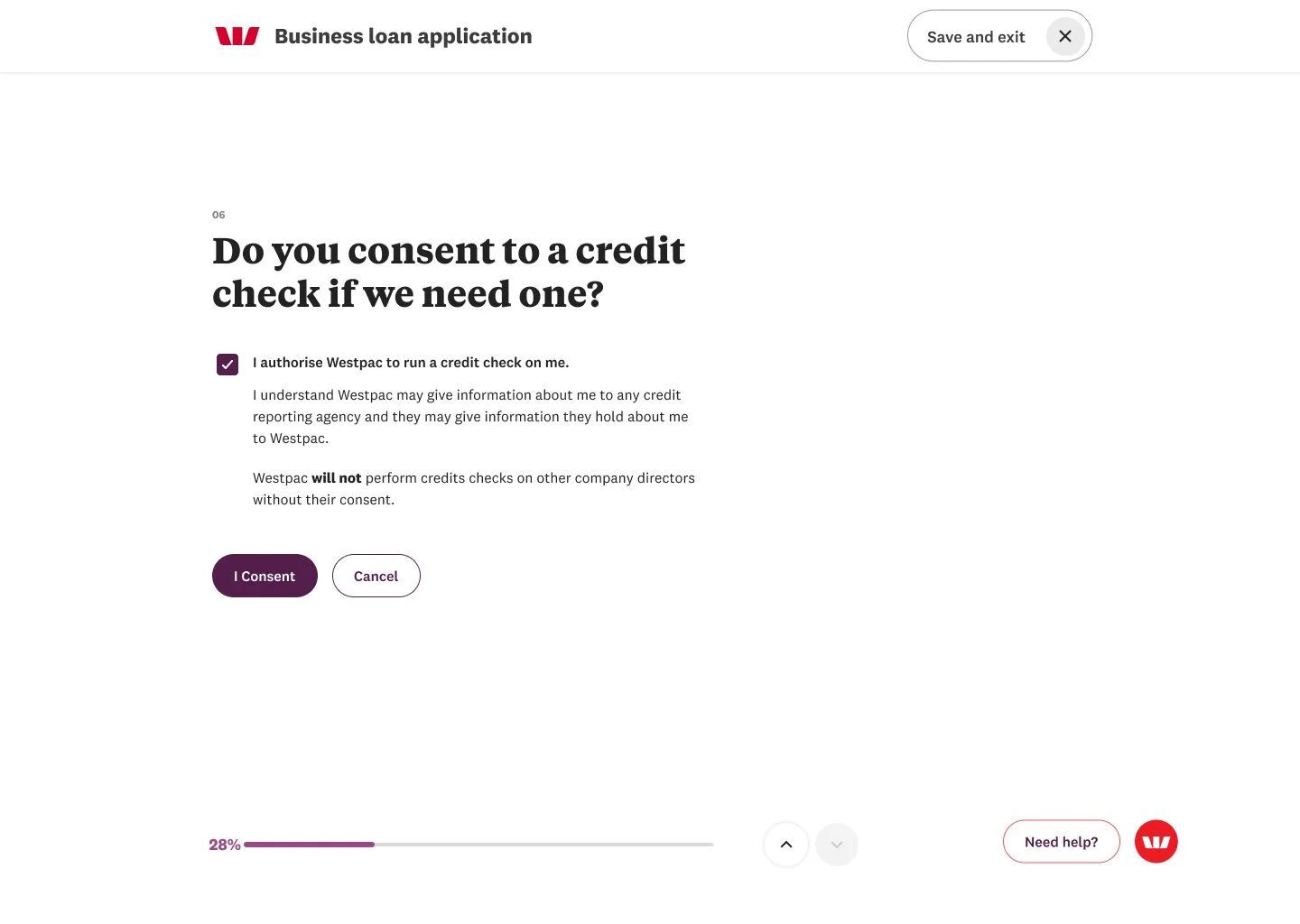

Prototype Testing & Iteration

Conducted usability testing with business customers on the high-fidelity prototype. Iterated flows based on observations, feedback, and task success rates.

UX Impact: Validates design decisions and identifies improvements before implementation.

Collaborative Ideation & Feasibility

Brainstormed ideas with service designers, technical experts, and product teams, assessing feasibility and refining concepts.

UX Impact: Aligns designs with technical and business constraints while ensuring practical solutions.

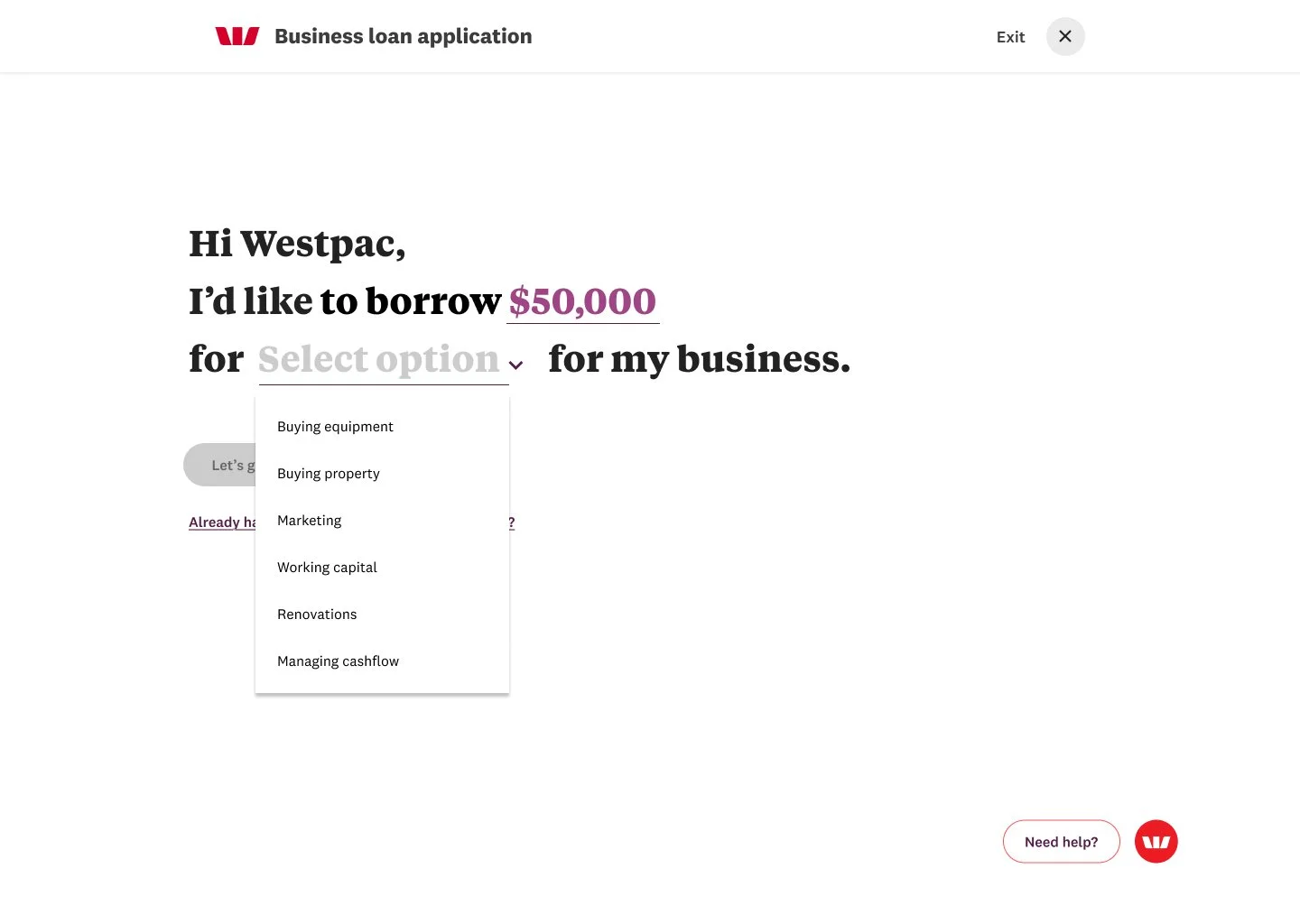

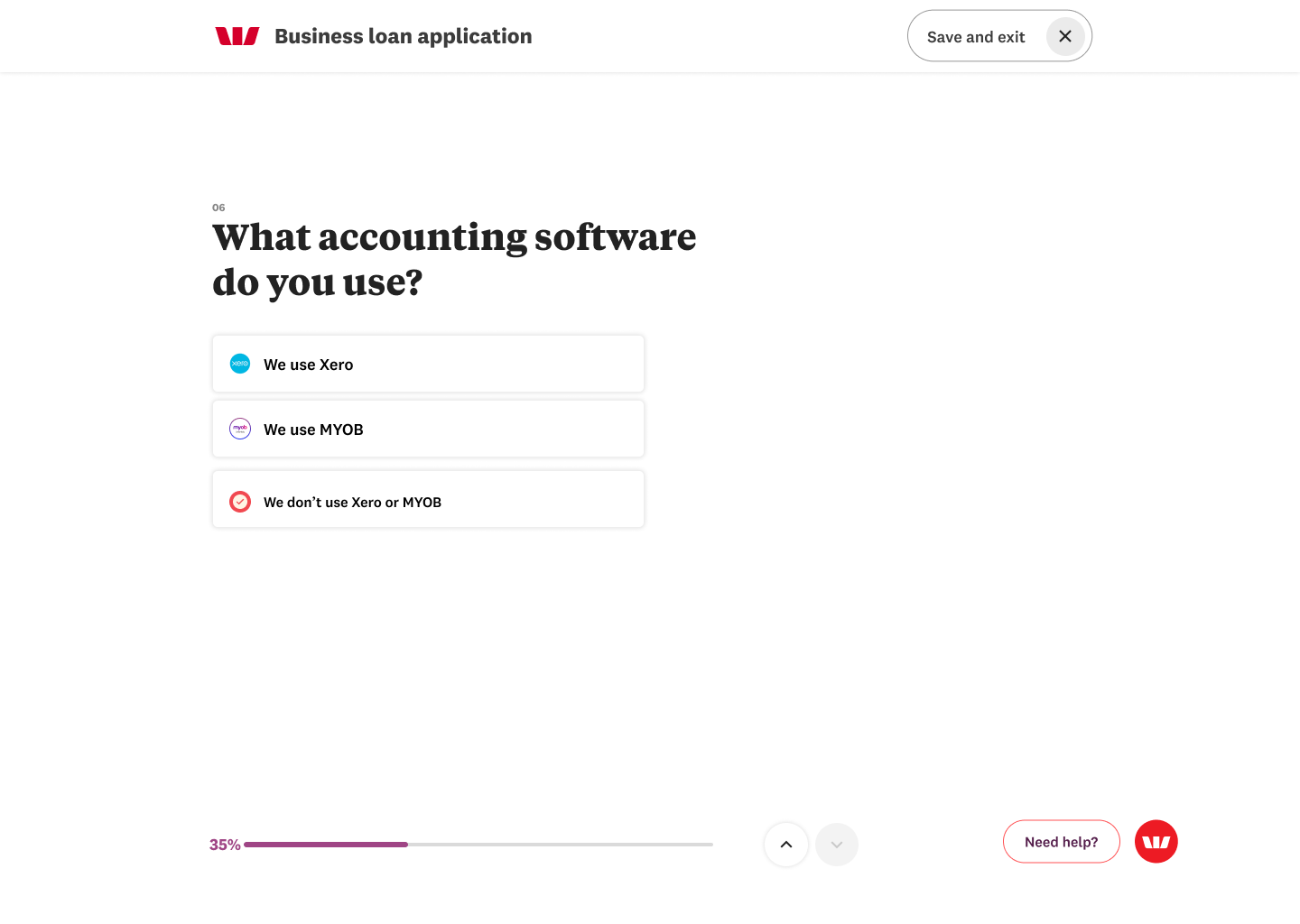

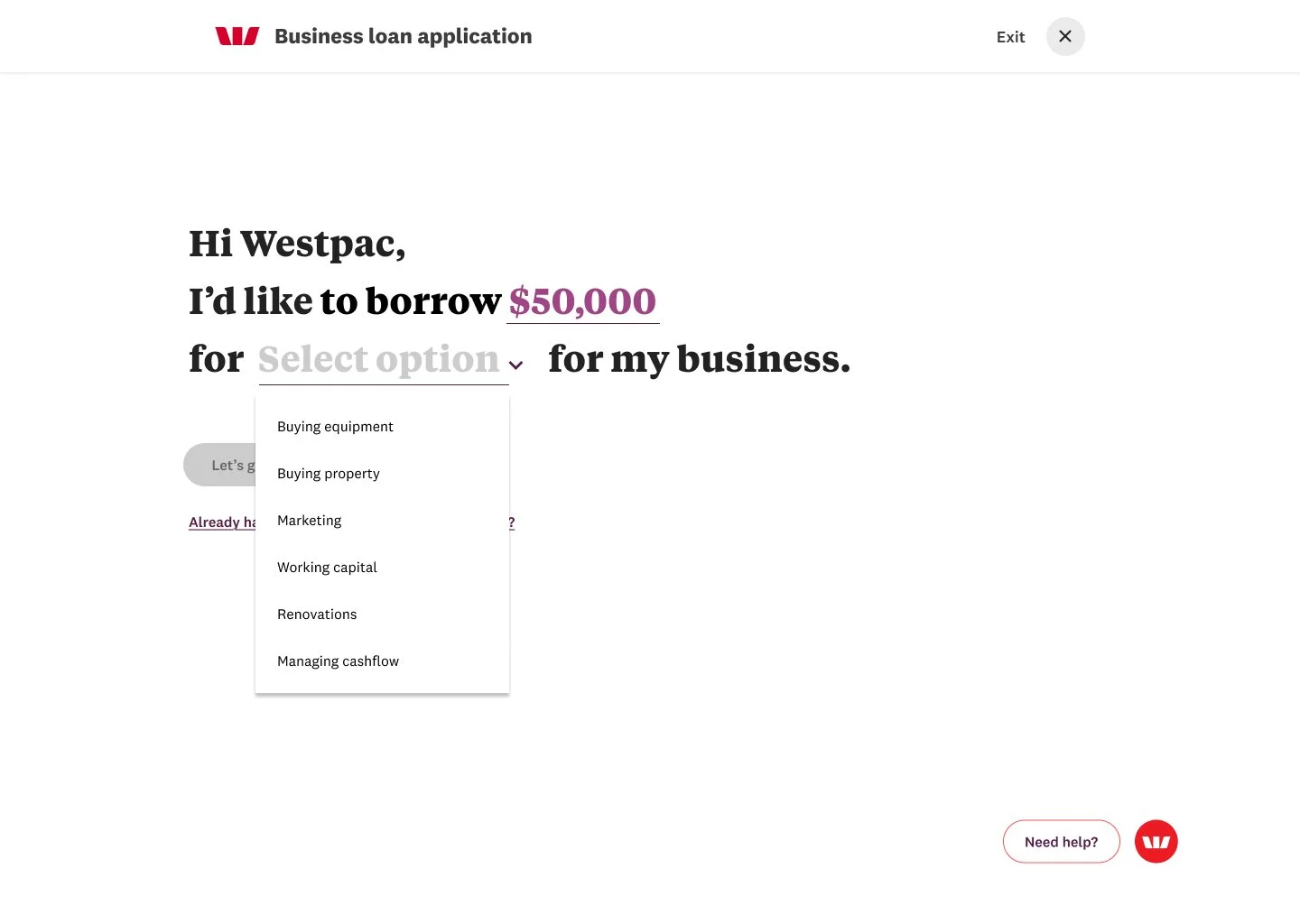

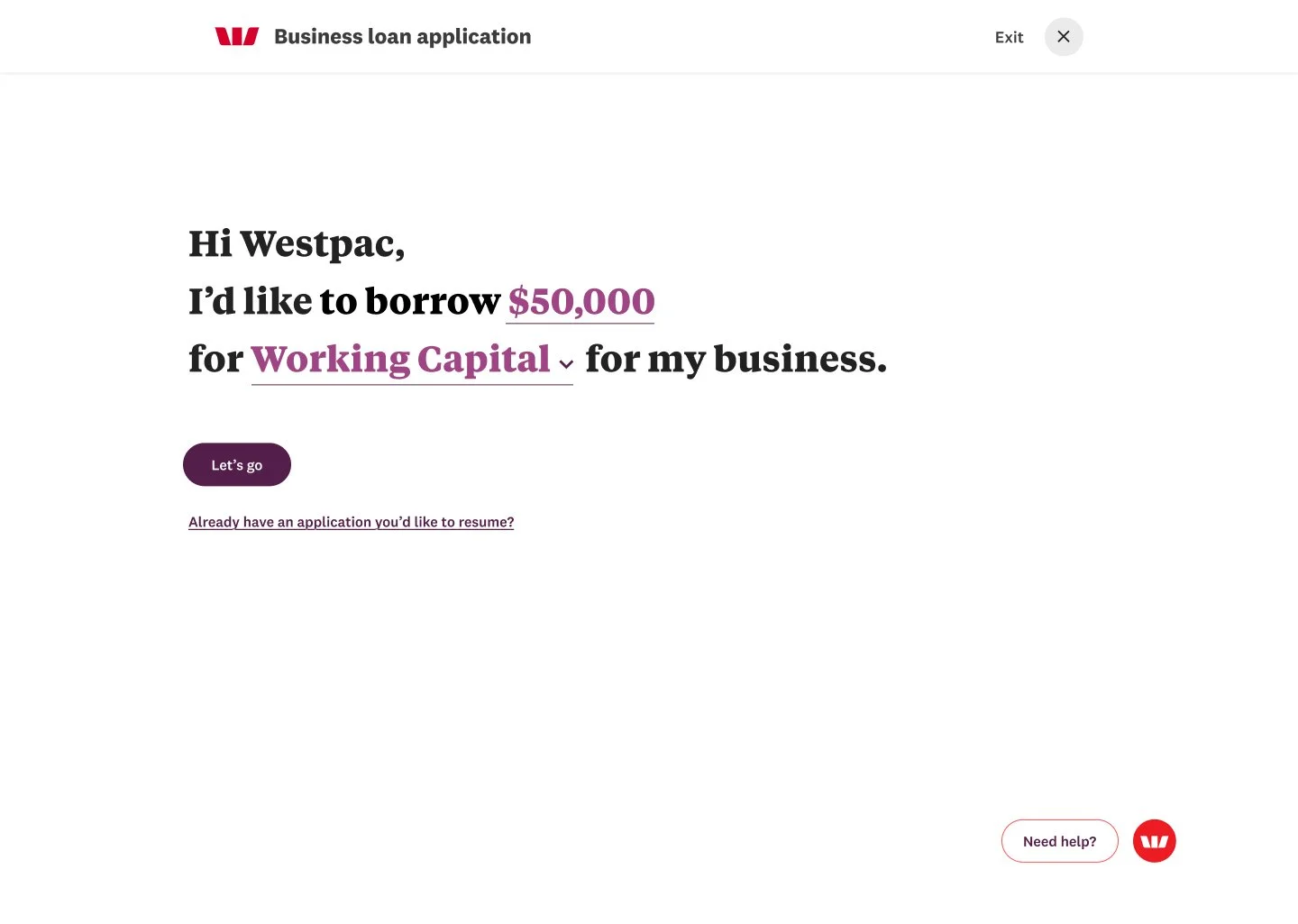

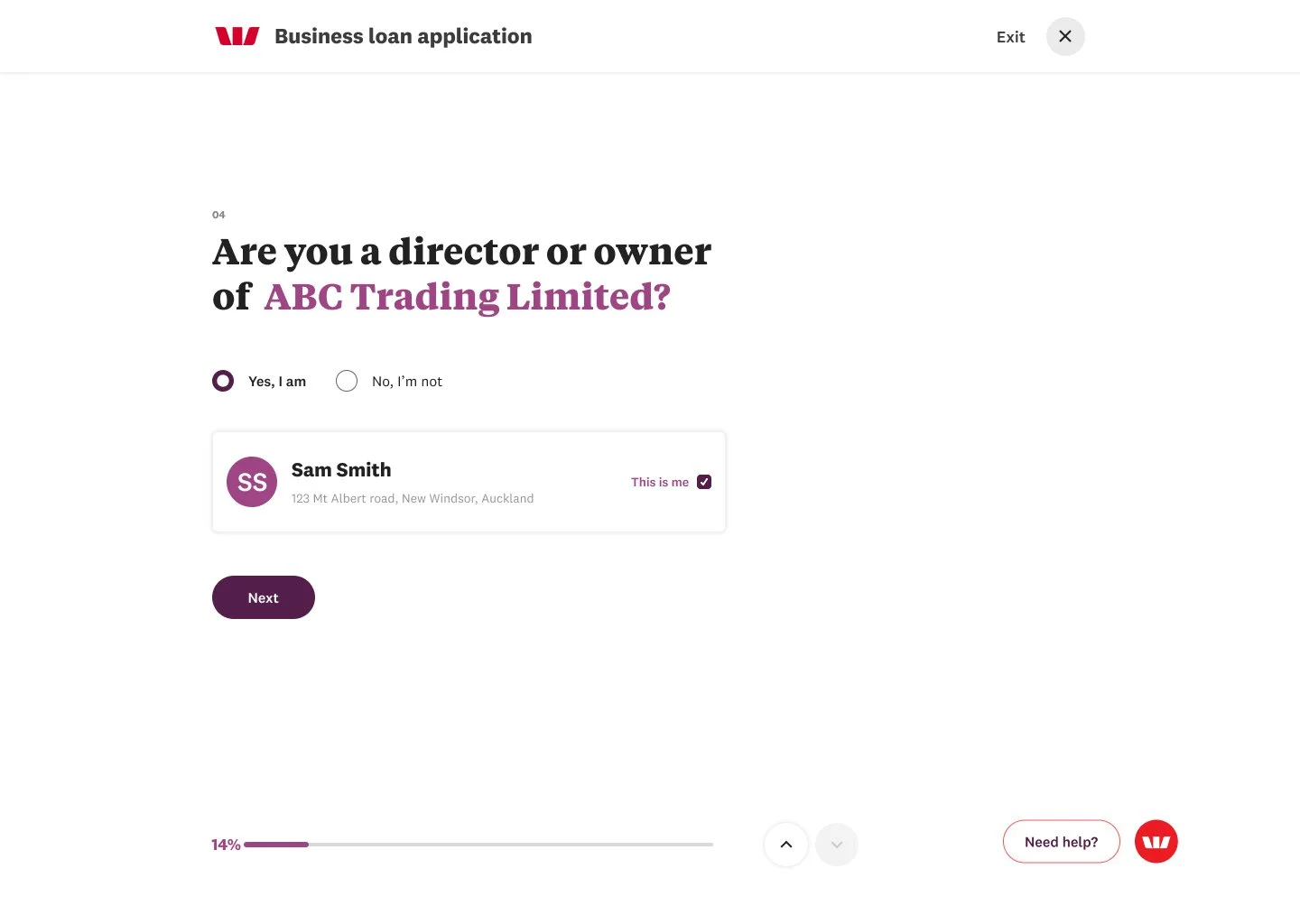

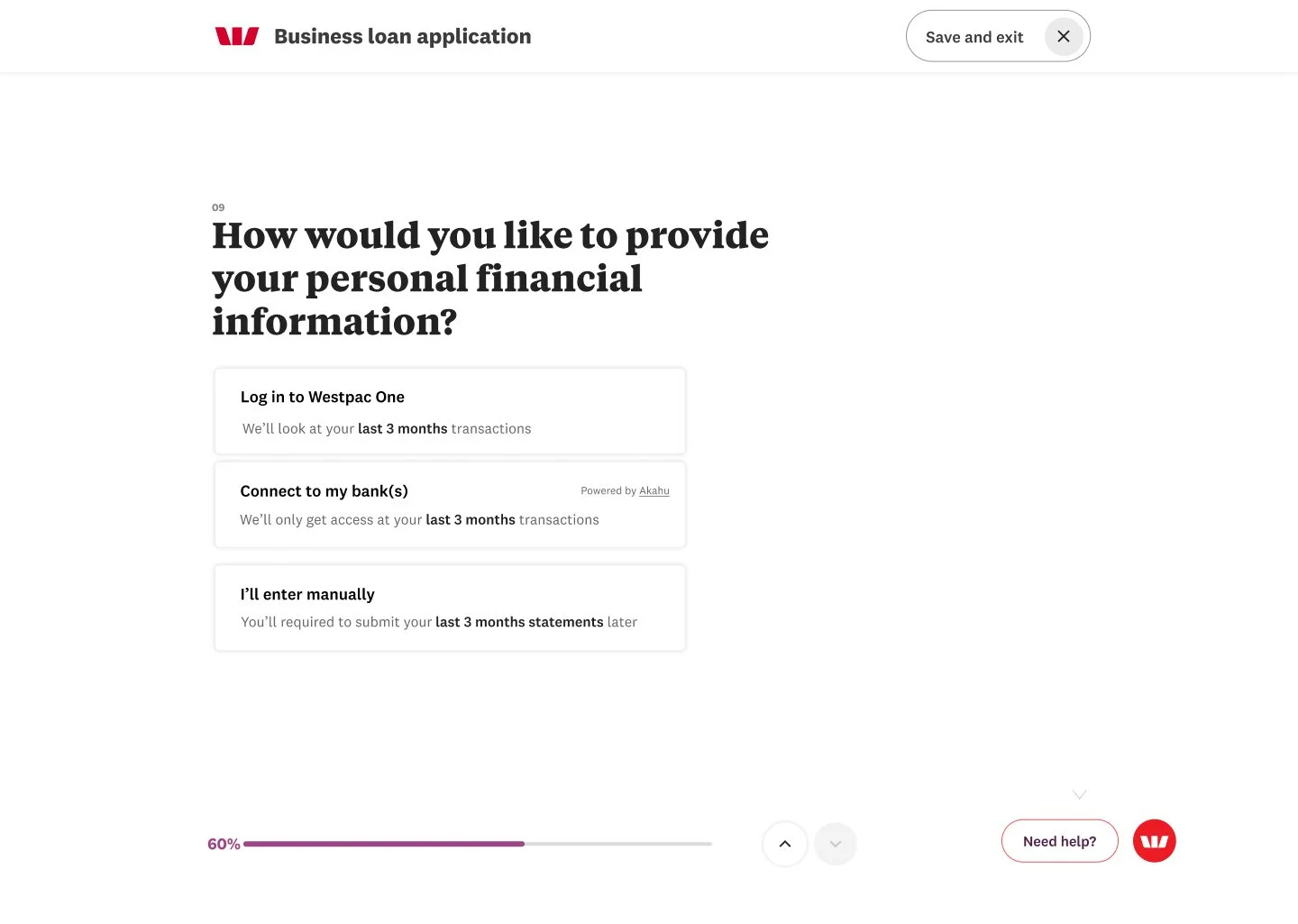

TypeForm

Replaced the traditional long form with a Typeform-style progressive questionnaire, intelligently adapting questions based on prior answers.

UX Impact: Reduces cognitive load and prevents user overwhelm.

Content Design

Worked closely with a content designer to craft clear, concise, and near-final prototype content.

UX Impact: Improves comprehension and reduces user errors during testing

Figma prototype

Typeform: Designing a genuine conversation

Type form can imitate conversation style, enhancing trust and engagement.

It offers interactive, conditional logic, allowing dynamic form responses based on user input.

Its visually appealing design and minimalistic approach can increase user engagement.

Other notable features

1. NZBN Integration

Automatically identifies the business and key people involved, such as directors, to streamline verification.

UX Impact: Reduces manual checks and speeds up onboarding for both customers and staff.

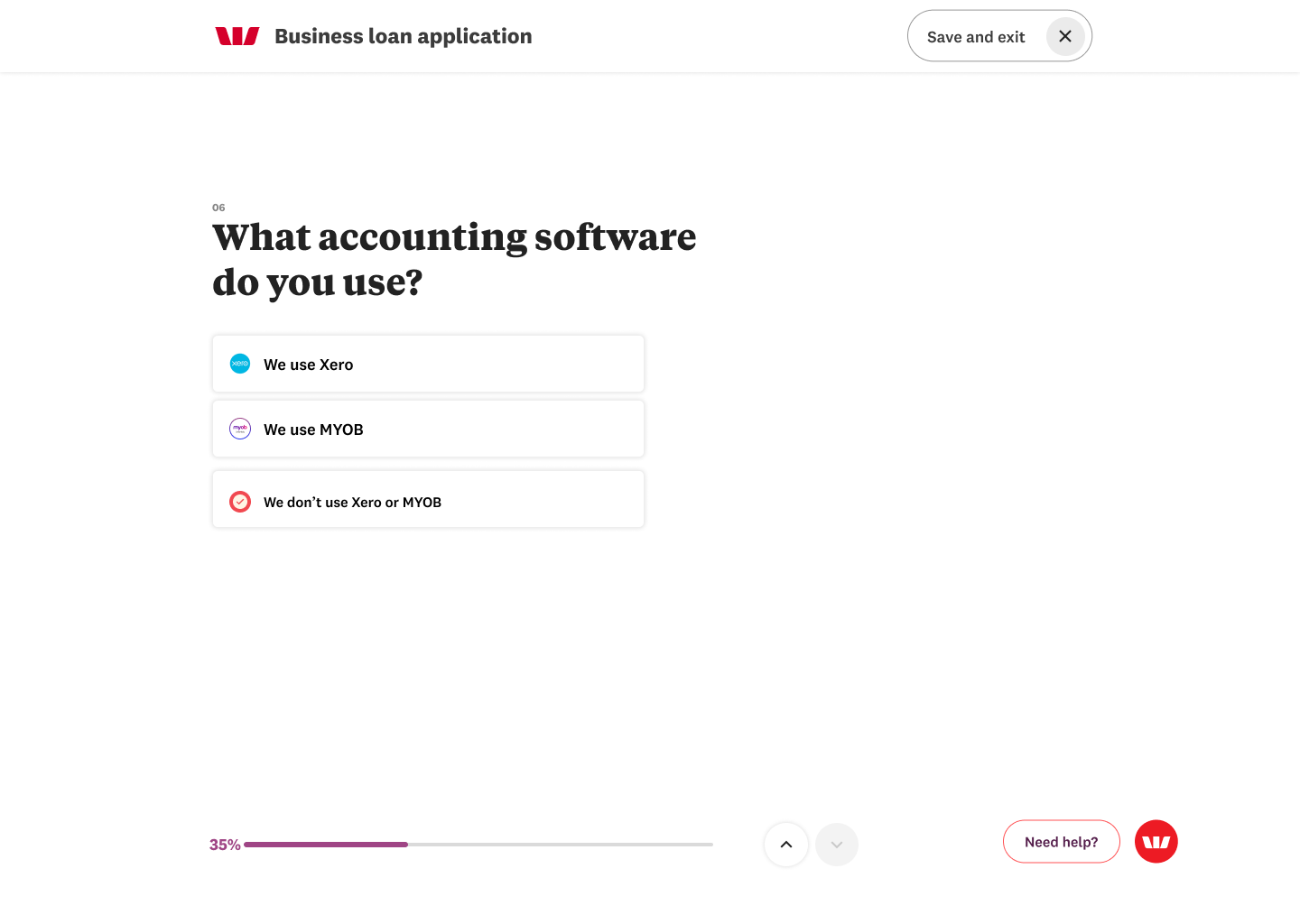

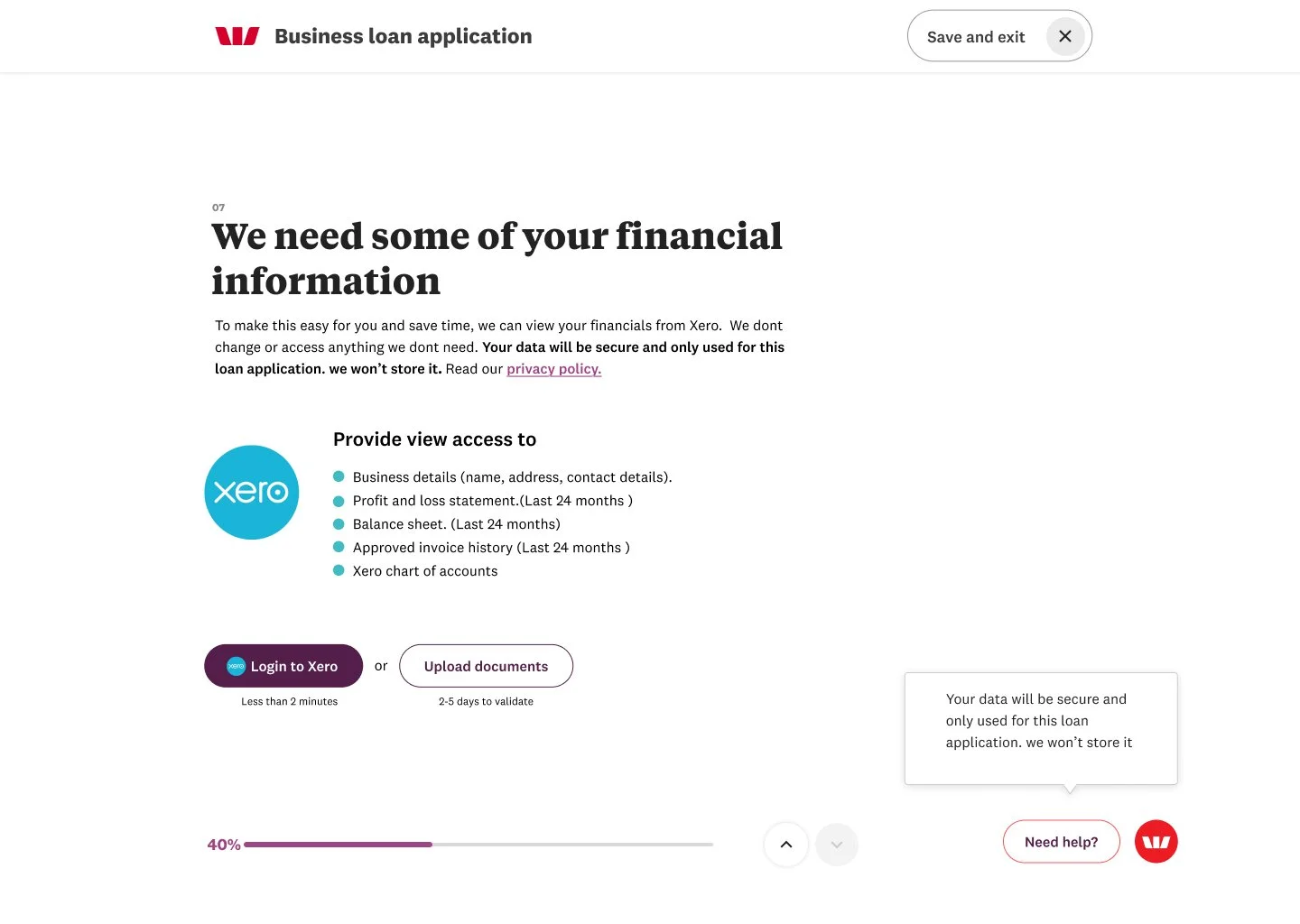

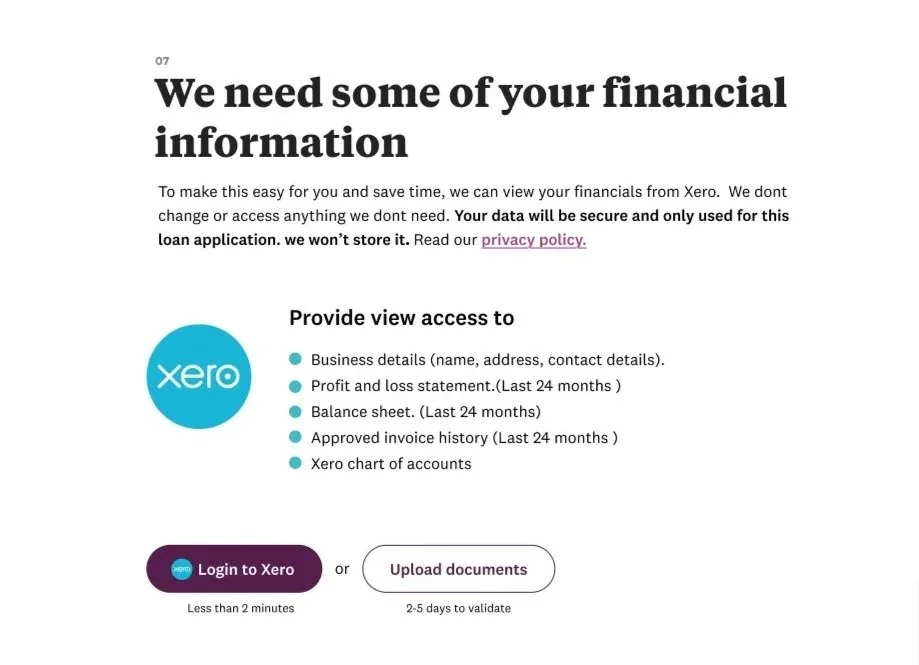

3. Accounting Partner Integration

Connects with platforms like Xero or MYOB to retrieve business financials directly, cutting down on manual data entry.

UX Impact: Saves time for customers and ensures accuracy of financial information.

2. Nature & Purpose Logic

Determines whether a business can be served online or requires manual handling, improving eligibility checks.

UX Impact: Guides users efficiently through the correct process, reducing frustration and errors.

4. Conditional Offers & Risk Profiling

Uses logical questions and risk assessment to provide conditional offers based on application completion and data quality, supported by a possible high-powered decision engine that Westpac could build.

UX Impact: Enables smarter, faster decisions and creates a more personalised experience for customers.

User testing & validation

We engaged an external agency to conduct in-person user testing over four days, targeting representative business customers. Senior leaders and high-profile stakeholders observed the sessions firsthand, seeing real users interact with the prototype and experiencing their reactions directly. One key goal was to demonstrate the value of research and human-centred design to the business.

Key Activities:

Conducted in-person usability testing with business customers.

Ran rapid iterative testing with immediate feedback loops.

Held breakout sessions with stakeholders to synthesise findings.

Facilitated ideation and dot-voting exercises to prioritise improvements.

This level of engagement was unprecedented at the bank. The process provided both practical insights for design iteration and a strategic demonstration of research-driven decision making.

Key learning

Prepared a detailed report and played back to the business

Trust is critical

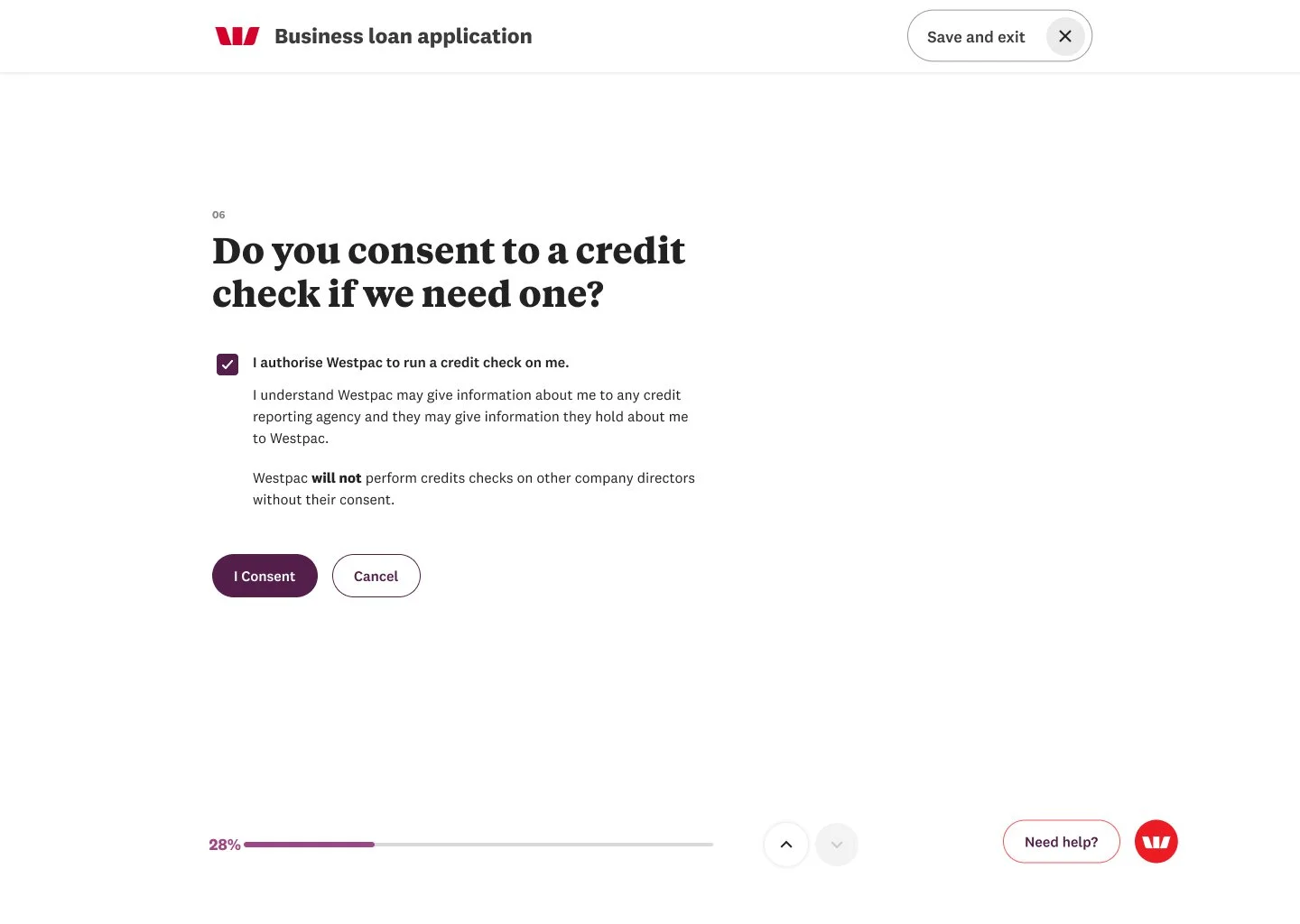

The biggest barrier was customer trust. Many were hesitant to share personal and financial information digitally, preferring to speak with a human first to feel assured about borrowing options and data accuracy. Several participants said they would only spend time entering details after a conversation with a bank representative.

Help & Guidance

A right-hand help panel, including live chat guidance, was largely ignored. Users felt it resembled advertising rather than support, highlighting the need for contextual, integrated guidance rather than separate panels.

UI & Experience Insights

Overall, the prototype performed well, and iterative testing allowed us to refine content multiple times. Features like “save and continue later” reduced friction for longer applications, though some non-Westpac users feared it implied a formal commitment to the bank.

Takeaway

While digital lending flows can simplify the process, human reassurance, trust signals, and clear guidance remain essential for adoption—especially for new or high-stakes customers.

Outcomes & next steps

This was a massive initiative that helped lay the foundation for a human-centred design way of working at Westpac and contributed to the growth of the Experience Design (XD) community. It also supported the establishment of an in-house testing lab and formalised design and research practices across the bank.

Developed reusable Typeform patterns and integrated them into the design system.

Opened discussions on where digital works versus where human support is essential, shaping future experience strategies.

Laid the foundation for Customer CareLab, a collaborative space for customer feedback and cross-team innovation.

Phase Two & Future Work

I explored multi-director and joint applications and helped conceptualise the “Application Hub”. These concepts were tested with users, but technical limitations paused full implementation. Research, patterns, and insights have been handed over to guide future enhancements.

My Takeaways

Trust is hard to earn digitally—human touch points remain critical in when huge money and financials involved.

Sidebars and contextual help are often ignored; guidance must be integrated into the flow.

People prefer human interaction where possible

System-wide thinking enables scalable, consistent solutions.

Strengthened my skills in project management, stakeholder engagement, and agency collaboration.

Above all, I learned how to simplify complexity for both users and the business.